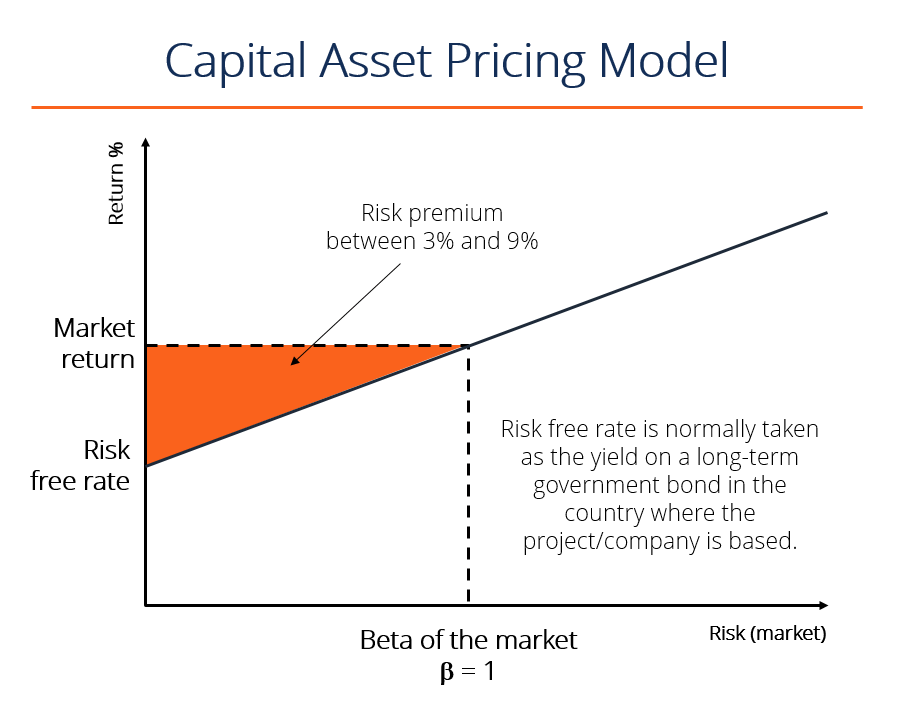

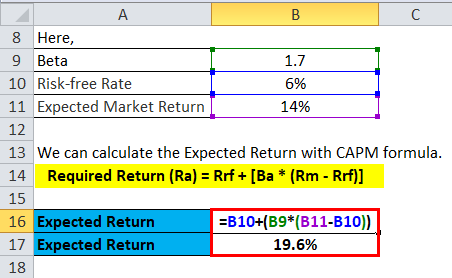

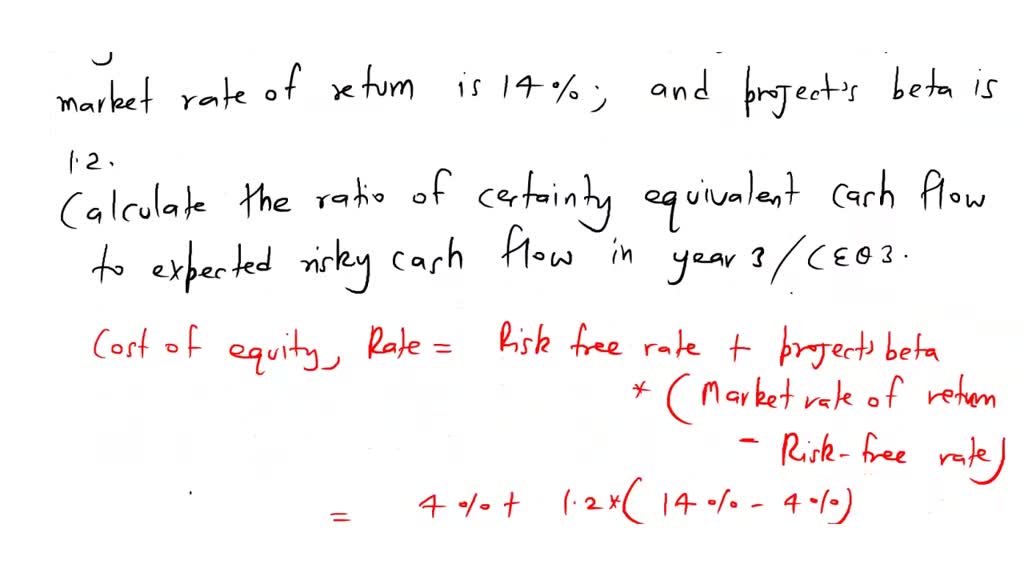

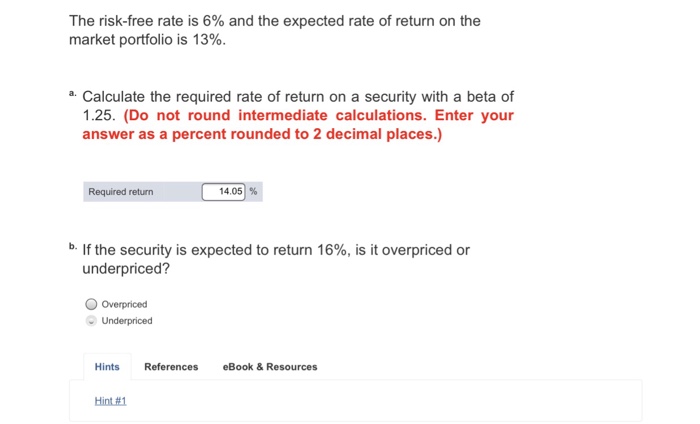

SOLVED: A project has an expected risky cash flow of 500 in year 3. The risk-free rate is 4%, the expected market rate of return is 14%, and the project's beta is

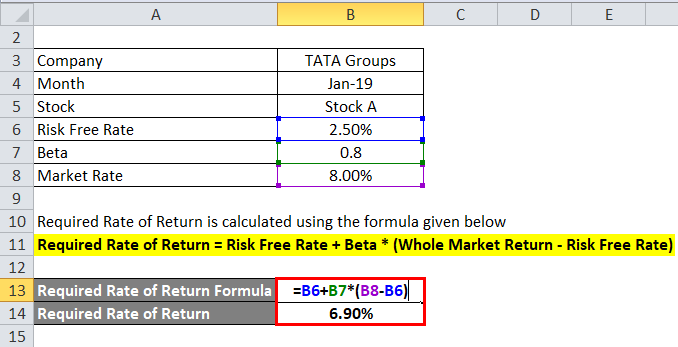

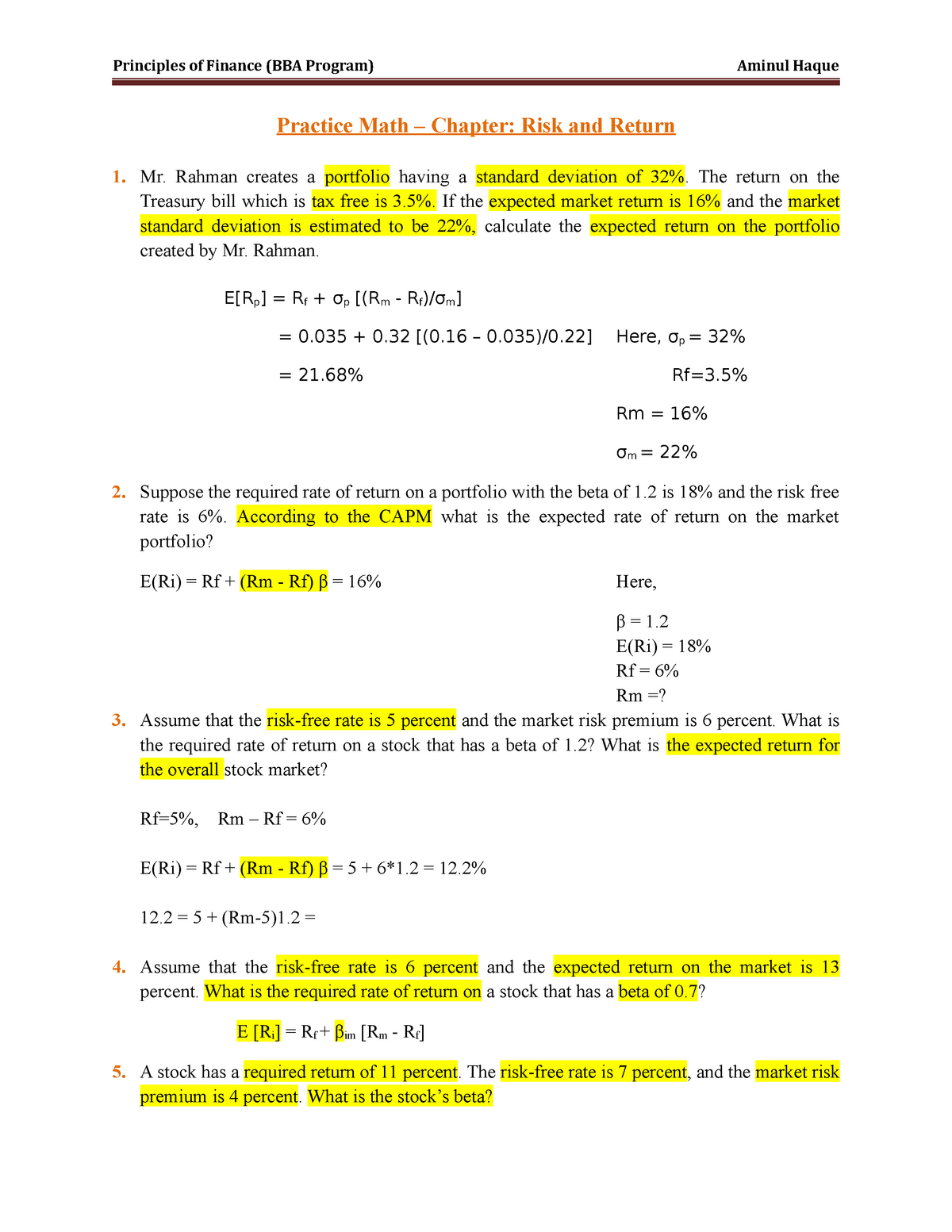

modern portfolio theory - Given two risky stocks calculate the rate of return, standard deviation, beta, and risk-free rate - Quantitative Finance Stack Exchange

:max_bytes(150000):strip_icc()/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)